Powered by Hall CPA

Reduce Taxes, Simplify Bookkeeping, And Build Wealth!

Discover strategies that have saved 2,500+ real estate investors millions in taxes and get support from real estate tax experts!

What others are saying:

SO much information! These guys are great at explaining somewhat complicated processes in an easy to understand way (and more importantly without sending anyone to sleep!)

Karen Canfield

This was worth the price 25x when I consider the tax savings from everything I learned... I feel much more confident about my position for material participation in my STRs and to successfully go for REPS.

Annie

Access Our Suite of REI Tax Content...

EXCLUSIVE FOR TAX SMART INSIDERS!

Your Exclusive Content & Resources As A Tax Smart Insider ...

The Tax Smart Roadmap

Your Path to a Tax Smart Portfolio

$2,279 Value

- Tax Strategy Foundation Course ($1,482 Value)

Tax Strategy Foundation is designed to guide you through the tax strategies available to anyone investing in rental real estate, from the basics of deductions to the advanced strategies including offsetting your W-2 or business income with rental tax losses.

Covers REPS, the STR Loophole, cost segregation, bonus depreciation, 1031 exchanges, and everything in between!

- Bookkeeping Course for Landlords & STR Owners ($797 Value)

Join 850+ students and streamline your accounting system to save time, maximize tax savings, and make better financial decisions to grow your portfolio with our QBO Bookkeeping Course for Landlords & STR Owners.

These two courses are normally $2,279, and now included in your Tax Smart Insiders Membership!

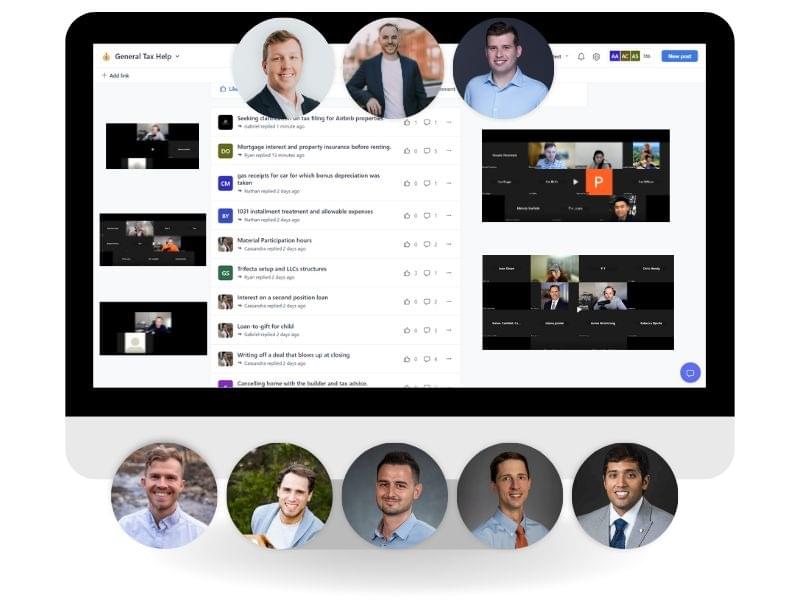

Expert Support from Real Estate CPAs

$1,164+ Value

-

Live Q&As

Join Live Q&As with our team of real estate tax experts and get answers to your most pressing tax questions and learn about what other investors are asking!

-

Private Forums

Your membership includes access to a private community forums where you can get your questions answered by our team of real estate tax and investing experts.

-

1-1 Consultations

Request 1:1 paid consultations with the same team of real estate tax experts that our private clients use to gain further clarity on what you need to minimize taxes for your specific situation.

Monthly Masterclasses & Archive

$1,297+ Value

- Monthly Masterclasses

Every month, we host masterclasses with experts covering market analysis, building and optimizing rental portfolios, investing in short-term rentals, tax deductions, LLCs, legal issues, and more.

- Masterclass Archive

Access our ever-growing backlog of previous Masterclasses!

Tax Smart Bonuses

$297+ Value

- Best of The Tax & Legal Summit

You’ll get all 69 sessions and all 6 Keynotes, 6 Live Q&A sessions, and 2 Workshops from the recent Tax & Legal Summits covering: REPS, STR Loophole, Cost Segregation, Entity Structuring, 1031 Exchanges, Trusts & Estates, and more!

- Members-Only Podcast

These days, everyone's busier than ever. Take our exclusive hard-hitting tax and real estate investment content with you on the go with the member-only podcast.

- Tax Smart eBooks

• The Real Estate Professional Status for Landlords: The Ultimate Guide to Eliminating Your Tax Bill While Sleeping Well at Night (eBook)

• The Ultimate Guide to Tax Planning For Landlords and Buy & Hold Real Estate Investors (eBook)

- Members-Only Discounts

Meet the TSI Community Leaders

Thomas Castelli, CPA, CFP® is a Tax Strategist, and real estate investor who helps other real estate investors keep more of their hard-earned dollars in their pockets and out of the government's.

Over his tax career, he has worked 1-1 with 100+ real estate investors to help them reduce their tax bills using tax strategies such as REPS, the STR Loophole, cost segregation studies, bonus depreciation, and much more.

Now he's on a mission to bring these strategies to the masses!

Ryan Carriere, CPA is a Senior Tax Advisor who helps real estate investors save thousands in taxes using strategies such as REPS, STR Loophole, and everything in between.

He is also a real estate investor himself and has acquired several rental properties, including his own STR.

He's now on a mission to help investors capture the powerful tax benefits of these strategies on their tax returns.

Brandon Hall, CPA is a Certified Public Accountant, national speaker, and is the Founder/Managing Partner of Hall CPA PLLC. Brandon works with real estate investors, syndicates, and private equity funds to optimize tax positions and streamline accounting and business functions. He believes that real estate investing is critical to building sustainable and generational wealth. Brandon worked at PricewaterhouseCoopers and Ernst & Young prior to

launching his own CPA firm, Hall CPA PLLC (The Real Estate CPA).

Through the knowledge gained by working with real estate investors, Brandon has

built a real estate portfolio of 25 units consisting of multi-family, single family, and short-term rentals.

Still Not Convinced? Just Hear What Our Clients and Members Have to Say...

CUSTOM JAVASCRIPT / HTML

Here's EVERYTHING You Get When You Become a Tax Smart Insider!

-

Expert Support from Real Estate CPAs................................................($1,164+ Value)

- Tax Strategy Foundation Course...........................................................($1,497 Value)

-

QuickBooks Online (QBO) Bookkeeping Course................................($797 Value)

-

Monthly Masterclasses & Archive......................................................($1,297+ Value)

-

Tax Smart Bonuses............................................................................($297+ Value)

Total Value: $4,037+.... FIRST MONTH ONLY $27

Then only $97/mo.

What Others Are Saying...

CUSTOM JAVASCRIPT / HTML

Frequently Asked Questions:

Q: Who is Tax Smart Insiders For?

A: This is for the self-starter. The investor that wants to implement real tax and accounting strategies for demonstrable results. This is for the real estate investor that wants to reduce taxes and build wealth without having to sort through all the bad advice found on free online forums.

This membership hits you with real, working strategies that have helped countless real estate investors significantly reduce their tax bills and build their portfolios. Then, the Masterclasses, Live Q&As, and other resources dive deeper, giving you even more clarity and actionable insights you can use to reduce taxes and build wealth... which saves you time and money because you don’t have to figure it out yourself or pay tens of thousands of dollars on 1-1 consulting! Let us show you the mistakes, so you can learn and grow without taking on needless frustration.

Q: Who should NOT join Tax Smart Insiders?

A: Hmmm...that's a tough one. I guess investors who like paying more tax than necessary? No, but in all seriousness, if you don't own real estate or plan to invest in real estate, then this community isn't for you.

Q: How do I access my Tax Smart Courses & Bonuses?

A: All the bonuses can be found conveniently right inside the community platform hosted on Circle. The courses will also be available in the community platform under the "Tax Smart Roadmap" tab on the navigation panel.

What Is Included In The Tax Strategy Foundation (TSF) Course?

A: Tax Strategy Foundation is designed to guide you through the tax strategies available to anyone investing in rental real estate, from the basics of deductions to the advanced strategies including offsetting your W-2 or business income with rental tax losses.

After completing these courses, you understand key tax strategies you can use and how to implement them to save THOUSANDS in taxes, including:

After completing these courses, you understand key tax strategies you can use and how to implement them to save THOUSANDS in taxes, including:

• The Real Estate Professional Status (REPS)

• The Short-Term Rental (STR) Loophole

• How to Use Passive Losses to Minimize Taxes

• Optimizing your Tax Position

• How to Exit Real Estate Tax Efficiently

• Investing Through Retirement Accounts

• Entity Structuring for Landlords

• Shifting Income to Children

• Audit Defense

• And More!

What Is The QBO Boookkeping Course?

A: This course is designed to help you streamline your accounting system to save time, maximize tax savings, and make better financial decisions to grow your portfolio.

If you're still using spreadsheets or scrambling through a shoebox for your bookkeeping, it's time to upgrade...

If you're still using spreadsheets or scrambling through a shoebox for your bookkeeping, it's time to upgrade...

The QuickBooks Online (QBO) Bookkeeping Course for Landlords and STR Owners is designed to help you set-up and streamline your accounting system for your rental business.

And that's critically important because it allows you to understand the financial performance of your business, ensures you don't miss out on tax deductions, and makes tax filing a breeze.

Shoeboxes of receipts, spreadsheets, and disjointed property management statements aren't going to cut it... Serious landlords need a bookkeeping system.

So, What Are You Waiting For?

Q: How much does it cost?

A: The Tax Smart Insiders membership is only $27 for your first month. If you love us and agree we're the best real estate tax and investing membership to help your business thrive... even in these times... then you'll keep your access to the membership with the Tax Smart Roadmap, Masterclasses, Live Q&As, private Insiders podcast, and private forums for only $97/mo.

Q: Can I cancel my membership?

A: Yes, if you don't believe the Tax Smart Insiders community is the #1 community to help you reduce taxes and streamline your accounting system so you can make better financial decisions and build your wealth faster than you ever thought possible, then you can cancel your membership at anytime and you won't be billed again. No hard feelings!

Q: Can I just find real estate tax & investing content online?

A: Sure. But honestly, after helping hundreds of investors reduce taxes, we discovered that a lot of the free “advice” out there is just plain wrong and often costs investors thousands dollars in accounting and legal fees trying to correct - or worse, they end up paying thousands in back taxes, interest, and penalties after getting audited by the IRS…

Sometimes it's worth just spending a few dollars getting it right the first time…But, hey if you get stuck in that situation, we’ll happily help you get out of it for a fee ;).

But it doesn’t have to get to that point, you can reach into our vault and secure $3K+ worth of premium, actionable tax + investing courses & bonuses... But this offer will only be available for a limited time. Once we reach our membership cap, then that's it. So, don't wait! Join Tax Smart Insiders Today.

Q: Does Tax Smart Insiders focus on just real estate, or can it help personally and with my business?

A: Yes. While we specialize and add the most value to real estate investors, Tax Smart Insiders also covers the typical personal and business tax strategies real estate investors need to understand. This includes home offices, paying your children, LLCs, and other common deductions and strategies.

Q: How can I get answers to my accounting and tax questions?

A: You can get answers to your tax and accounting questions through the Private Community Forums, Monthly Live Q&As, and 1:1 Paid Consultations with our team of real estate tax experts.

Q: Are the Live Q&As & Masterclasses Recorded?

A: You Bet. All of our Live Q&As and Masterclasses are recorded and available for replay within the community and members-only podcast.

Q: Do your CPAs know real estate?

A: Yes! All of our CPAs are gainfully employed at Hall CPA, PLLC. The firm services over 1,200 clients in the real estate industry. Our team has incredible tax and accounting experience that we are able to rely on when servicing you!

Q: Do you offer a guarantee?

A: Yes! If you're not satisfied with your Tax Smart Insiders Membership, we will honor refund requests made in writing within the first 30 days of signing up.

Copyright 2023 by Hall CPA PLLC. All Rights Reserved.