About Tax Smart Investors

The #1 community for building a Tax Smart real estate portfolio!

The Story Behind Tax Smart Investors

Investors Deserve Reliable Tax Advice

Tax Smart Investors was born out of necessity. Nowhere could you find reliable and affordable tax advice for real estate investors.

Most tax professionals are still stuck preparing tax returns and don't have the time, or the expertise, to provide clients with advice that reduces their taxes.

It wasn't until our firm disrupted the industry that real esate investors could receive reliable advice. However, we realize that 1:1 tax planning is expensive and not in the budget for all investors.

We were talking to ~50 investors a week (it was exhausting) and over time came to realize two things:

(1) most investors had mistakes and missed opportunities buried in their tax returns; and

(2) only a fraction of the investors we spoke with could afford, or were willing to pay for, CPA services.

This was frustrating for us. Being a real estate investors ourselves, we value information that helps portfolios run better.

We were talking to hundreds of landlords each month identifying tax mistakes and missed opportunities that cost them thousands of dollars.

So we created Tax Smart Investors.

We wanted to cover everything from the basics to the complex tax issues you may face in your investing career. We wanted to dive deep into these topics... not just gloss over them.

We figured courses and a community group would be key to further your understanding and allow you to ask questions and get answers directly from real estate tax experts.

And now after helping hundreds of students and Tax Smart Insiders, we know we're on the right track.

The goal is simple: empower you to make better tax decisions with or without a tax advisor.

MEET THE EXPERTS

Brandon Hall, CPA

MEET THE EXPERTS

Thomas Castelli, CPA

Thomas is a Tax Strategist and real estate investor who helps other real estate investors keep more of their hard-earned dollars in their pockets and out of the government's.

Over his tax career, he has worked 1-1 with 100+ real estate investors to help them reduce their tax bills using tax strategies such as REPS, the STR Loophole, cost segregation studies, bonus depreciation, and much more.

Now he's on a mission to bring these strategies to all real estate investors and business owners!

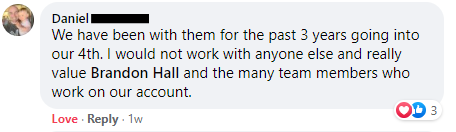

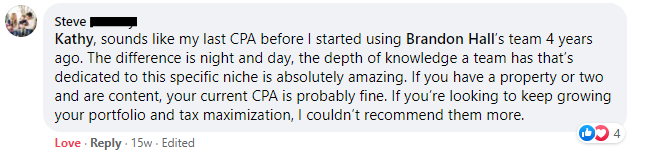

What Our Clients and Members Have to Say...