QuickBooks Online (QBO) Bookkeeping for Landlords & STR Owners

Streamline your accounting in just 3 weeks—save time, maximize tax savings, and make smarter financial decisions to grow your portfolio!

Join the QBO Bookkeeping Bootcamp!

Feb. 10th, 2025 - Feb 28th, 2025

Here's What You'll Get:

- 2-week course, 18 easy to learn lessons + Bonus Week of Support

-

Weekly Live Q&As on Thursdays at 7:30pm ET

- In-course Q&A to help you with your QBO system

-

Tools, handouts, and homework

1

Contact Information

Name, Email, Etc.

2

your info

Your Billing Info

* Denotes mandatory fields

Shipping

We Respect Your Privacy & Information

Discount Coupon Code:

Check the below box to confirm your understanding:

REFUND POLICY: We will honor all refund requests that are made by Feb. 14, 2025. Any refund requests made after this date will not be honored. By checking this box, you understand and agree to these terms.

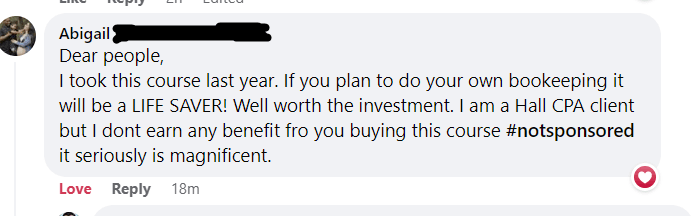

What Others Are Saying

I took this course and it really helped me set up my books!

— Karen Jackson

The QBO Bookkeeping Bootcamp was a really great course with tons of valuable information. I highly recommend it to anyone that wants to get a better handle and/or understanding of their bookkeeping.

— Ryan Pulice

Highly recommend QBO Bookkeeping Bootcamp. It has given me a solid foundation to clean up my books, and provided a strong, user-friendly framework to ensure my records are in the best possible shape for my accountant at taxtime. Kristina knows her stuff, takes the time to answer questions in detail, and is also super friendly.

— Charity Sack

Definitely recommend this QBO Bookkeeping Bootcamp for Landlords & STR Owners course! Kristina makes everything make sense and teaches really well. Everything gets broken down really well! I had some ideas of this subject going in but learned quite a bit when it comes to the capital improvements portion. This is extremely helpful for the clients I have where this applies. The Q&A sessions were also very helpful to be able to spend time asking specific scenario questions or just to hear the other members questions get answered.

— Sandy Heit

Fabulous! I have been doing QB's for 18 years now and finally broke my 2 commercial properties out into a separate company from my day to day business... Could not have successfully done this with out [this] course. At first things seem a little overwhelming, then she professionally takes the complex and breaks it down step by step making the student confident and successful! Would highly recommend the course, love using all the short cuts and new QB's features. This course really does cultivate a QB's life time learner.

— Daniel Hockstra

Join the QBO Bookkeeping Bootcamp!

Feb. 10th, 2025 - Feb. 28, 2025

Here's What You'll Get:

- 3-week bootcamp, with easy to learn lessons

-

Weekly Live Q&As on Thursdays at 7:30pm EST

- In-course Q&A to help you with your QBO system

-

Tools, handouts, and homework

Bootcamp Agenda

-

Part I:

- Setting up the foundation of your QBO account

- How to capture operating expenses

- How to capture property-level transactions

(mortgage statements, repairs and maintenance, capital improvements, property management transactions, rental income, and more)

- Importing the real estate chart of accounts -

Part II:

- How to capture the acquisition of a property

- How to capture refinances and sales of property

- Matching your books to a prior-year tax return

- How to maximize your use of QBO’s features

“By the end of this bootcamp, you'll have a streamlined bookkeeping system built for your rental business. And that's critically important because it allows you to understand the financial performance of your business, ensures you don't miss out on tax deductions, and makes tax filing a breeze. Serious landlords need a bookkeeping system."

— Brandon Hall, CPA, Founder of Hall CPA, PLLC

FAQs